Article Posted October 25, 2012

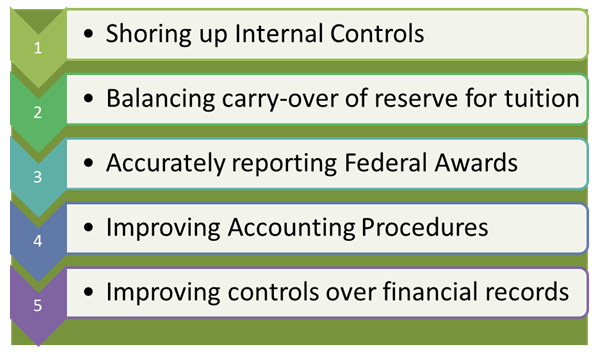

5 Most Common External Audit Issues - FY2011

The Education Audit Division of the Georgia Department of Audits and Accounts performs financial and compliance audits and other engagement activities for all public colleges and universities within the state of Georgia each fiscal year.

The USG Office of Internal Audit and Compliance, along with other administrative divisions within the USG enterprise, closely monitor the results of these external audits, and track the resolution of any identified issues as a standard business practice. The following represents the five most commonly identified issues across all USG institutions, along with a brief description of the recommended resolution.

These issues have been grouped and summarized by commonly identified categories; nearly 20 percent of all identified FY 2011 issues were associated with one of the following issue categories. We present these as recommended best practices in the hopes of limiting their occurrence throughout USG in future audit engagements.

1. Inadequate internal controls

a. Issue – Management is tasked with maintaining internal controls of a level necessary to provide reasonable assurance that stated balances and amounts are properly documented, processed, and reported.

b. Recommended resolution – Implement policies and procedures which ensure all balances and amounts are properly documented, and regularly reviewed and reconciled.

2. Reserve for tuition carry-over was improperly calculated

a. Issue – Budget basis reserves reported by the institution on the Summary Budget Comparison and Surplus Analysis Report must be properly documented, validated, and appropriate.

b. Recommended resolution – Management should ensure all information presented as part of its financial statements, including budgetary amounts required by state accounting regulations, is maintained in an accurate manner along with appropriate supporting documentation.

3. SEFA information did not agree with federal expenditure activity reflected in accounting records

a. Issue – The Schedule of Expenditures of Federal Awards reported by institutions to the Georgia Department of Audits and Accounts must be properly presented, and supported by the institution’s accounting records.

b. Recommended resolution – Management should regularly review the financial data produced by its official accounting systems, and regularly reconcile federal award data to reported amounts to ensure these figures agree.

4. Inadequate accounting procedures

a. Issues – Management must establish, maintain, and monitor internal controls for the purpose of ensuring the fair presentation of all accounting and other financial statements.

b. Recommended resolution – Implement policies and procedures focused on strengthening the accounting and financial reporting processes, to include regular review and reconciliation, and appropriate segregation of duties as needed.

5. Inadequate controls over financial reporting

a. Issue – Adequate controls were not in place to ensure all required activity was included in the financial statement presented for audit, including ledgers other than the general ledger.

b. Recommended resolution – Management must implement and maintain a system of internal control as part of the preparation of the financial statement so that it is presented in accordance with generally accepted accounting principles.

Ted Beck, Auditor

Posted by Ted Beck

Published in: Audit Findings

Most Recent in: Audit Findings

Identity and Access Management

Posted by Ted Beck

August 17, 2011

Use of Major Repair and Renovation Funds

Posted by Ted Beck

August 08, 2011

Financial Aid Purge Protections

Posted by Ted Beck

August 02, 2011

View Articles by Category

Search

Contact

Internal Audit & Compliance

Board of Regents of the University System of Georgia

270 Washington Street, SW

Atlanta, GA 30334

Tel.: 404-962-3020

Fax: 404-962-3033

Email: .(JavaScript must be enabled to view this email address)